River Road Asset Management Addresses UniFirst Board Regarding Shareholder Concerns

LOUISVILLE, Ky., Dec. 05, 2025 (GLOBE NEWSWIRE) -- River Road Asset Management LLC (“River Road”), on behalf of its clients, owns approximately 881,000 Class A common shares of UniFirst (UNF), which represents 6.0% of the Class A shares and a 4.9% total ownership interest in the company. River Road is a value-oriented institutional equity manager with over $10 billion in total assets under management. We have been patient UniFirst shareholders since 2010.

This year, River Road has been profoundly disappointed with the decisions and actions of UNF’s Board and management team. The Board was unwilling to engage in good-faith negotiations with Cintas (CTAS) on its proposed acquisition of UniFirst for $275 per share, which represented a substantial premium to the prevailing UNF stock price. River Road considers this a breach of fiduciary duty and a consequential decision that recklessly ignored the best interests of all shareholders. When UNF confirmed the rejection of the CTAS offer in January 2025, the press release stated: “The UniFirst Board and management team remain confident in the strategy the Company is executing and the opportunities ahead to create significant value.” This statement is absurd and delusional based on the company’s lackluster operational track record since the passing of former CEO Ron Croatti in 2017 and ignores the significant execution risks inherent in UNF’s current plan.

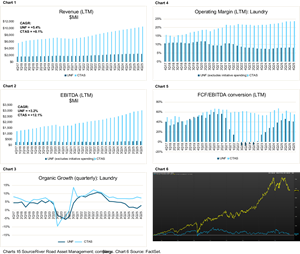

The core laundry business is a game of scale. The competitive moat widens with route density, which leverages fixed costs and allows for higher margins, better service levels, and superior pricing versus the competition. After UNF scrapped its Unity 20/20 CRM project in FY18, the company has been slow to upgrade its IT systems despite clear operational need. UNF’s financial performance peaked in FY19 and the company has subsequently struggled with labor and benefits inflation and merchandise cost pressure, while showing a limited ability to offset these headwinds through pricing. As the industry emerges from an inflationary cost environment, an increasingly competitive pricing environment has led to lower retention rates, slower new account wins, and margin erosion.

Under the tenure of current CEO Steve Sintros, UNF has significantly lagged Cintas in every important operational metric (see charts). Historically, Cintas has traded at a premium EV/EBITDA multiple to UNF given its superior scale, more efficient operations, and lack of a controlling shareholder. However, this multiple gap has significantly widened over the years. As CTAS continues to grow at a faster clip than UNF, so does its competitive advantage and its value proposition to customers. Eventually, CTAS will use this edge to further encroach on UNF’s core markets with market share losses to CTAS likely to accelerate. Unsurprisingly, the share price of UniFirst has languished as a result.

When rejecting the CTAS offer earlier in the year, UNF management acknowledged that even if it delivered on its longer-term guidance, it would likely take until 2029 or 2030 to deliver the EBITDA growth needed for UNF to reach a valuation of $275 per share without aggressive multiple expansion. Yet only three quarters later, expectations for 2026 have already been walked back, and 2026 has now been deemed an “investment year.” Since January 2025, the consensus EBITDA estimate for UNF’s FY27 has fallen -11%, and the stock fell below where it traded prior to the CTAS offer. This has been a common theme in the past several years given the slow and costly implementation of UNF’s new ERP system and other missteps.

By pursuing the current path selected by the Board, UNF is taking significant operational and execution risk given its seven-year trend of anemic operating results. To provide more upside potential for shareholders, River Road encourages the Board of Directors to explore strategic alternatives for UniFirst. River Road believes a sale represents the most compelling path to maximize value for all shareholders while eliminating execution risk. To further support the firm’s views, River Road intends to vote for Engine Capital’s nominees at the annual meeting scheduled for December 15, 2025.

About River Road Asset Management:

River Road Asset Management, LLC is an institutional asset management firm based in Louisville, KY, specializing in value-oriented equity investment strategies. As of October 31, 2025, the firm manages more than $11 billion in total assets (including $9.4 billion in assets under management (as defined by GIPS®) and $2.0 billion in advisory-only assets). River Road serves leading institutional investors worldwide, including corporations, endowments, government entities, OCIOs, foundations, family offices, and retirement plan sponsors. The firm provides solutions to meet client-specific guidelines through a variety of investment vehicles, including separate accounts, model portfolios, collective investment trusts, and sub-advised U.S. and non-U.S. mutual funds. River Road is majority-owned by Affiliated Managers Group, Inc. For more information, please visit www.riverroadam.com.

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/74d6d426-4694-4ec9-8685-5ea424a4b157

Contact Justin Akin Senior Portfolio Manager 502-371-4100

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.